Cash flow, Product features

How to use ThinkOut for cash flow management

March 10, 2021

Your cash flow is your company’s financial health indicator and you probably already know how important it is to carefully monitor it. Keep updating your cash flow periodically and it will be easier for you to get a glimpse of your cash on hand together with the next expected inflows and outflows.

Need to make sure that you keep your business afloat for the next month? Then start forecasting and check your future cash position. Sure, you can do it in Excel or Spreadsheets, but this will cost you a lot of time and energy. Managing your cash flow in Excel is burdensome and prone to human error.

If you are looking for an easier way to do it, try ThinkOut, the cash flow management and forecasting platform for entrepreneurs. It’s free! With just a couple of clicks you set up your own cash flow statement which is daily refreshed so you can only focus on analysis and financial planning.

How does ThinkOut work?

ThinkOut is a cash flow management platform that helps entrepreneurs analyse and forecast their money movements based on the bank transaction history. Once the data source is connected, it aggregates and organises all transactions using a predefined category structure, which can be edited based on your particular needs.

This way it’s easier to forecast and keep track of your next expected ins and outs. You get a clear overview of your future cash position, know exactly which predictions became reality and make sure that all due invoices will be paid by the end of the month.

How to use ThinkOut?

First step – connect your data source

Connect your bank accounts in ThinkOut and save time. The platform will automatically aggregate all your daily transactions so you always have a clear picture of your current cash on hand. Check which banks are currently available for connection in your country.

If your bank is not on the list, you can import your bank statements manually. Actually, you can import any financial data about your company – such as a list of invoices, forecasts, sales reports – as long as the documents are saved as CSV/XSLX.

Confirm the automated categorisation of your data

ThinkOut will automatically organise your bank transactions based on a predefined category structure (which you can easily edit). Check if your data is correctly classified and change the category where needed. ThinkOut will continuously learn from your actions so the next time fresh data is imported, your transactions will be assigned to the correct category.

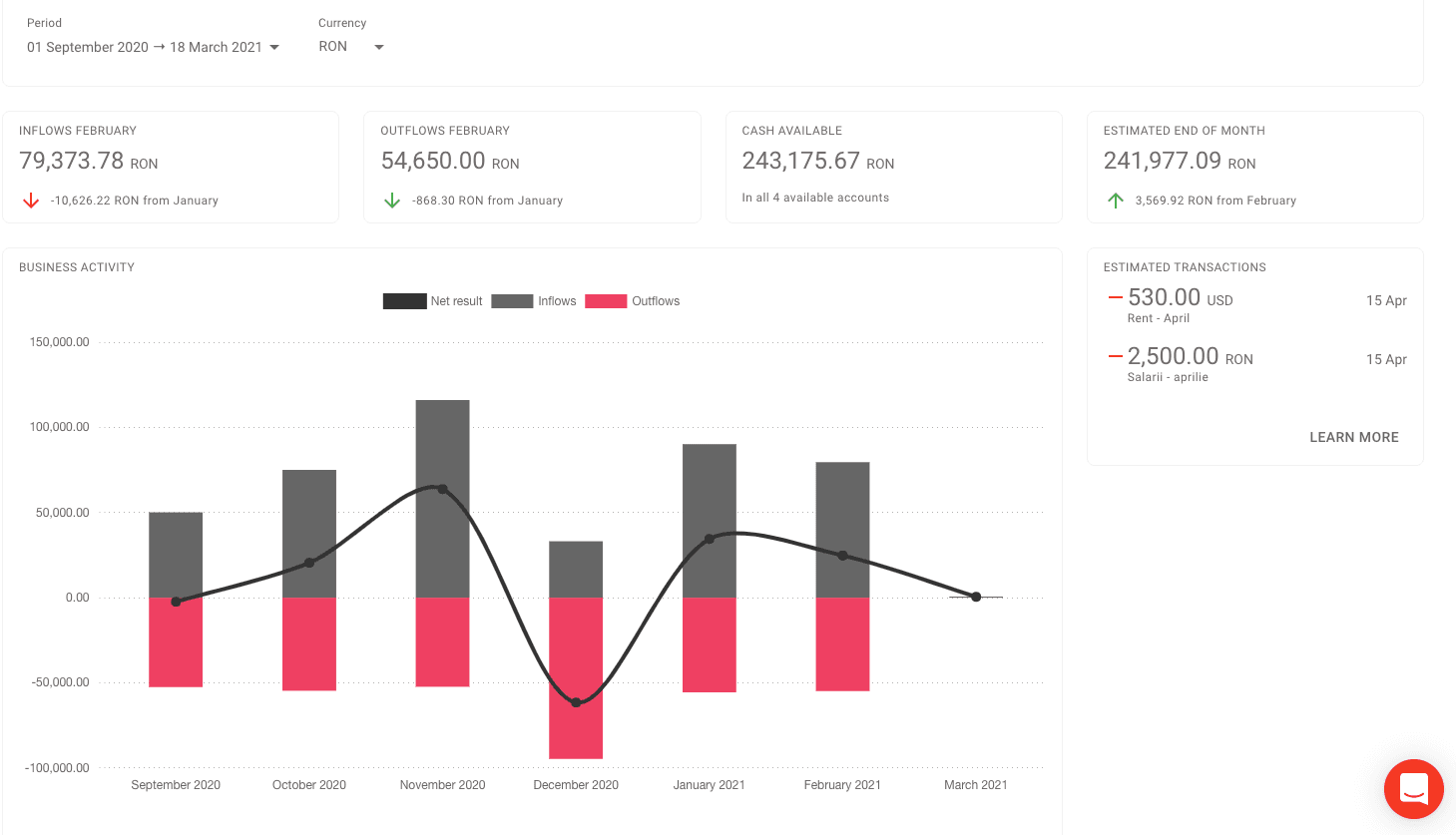

Check the financial picture of your business

Verify and analyse your transactions history in a friendly interface. Identify your best months and your rainy periods, see which are your biggest monthly expenditures and what percentage from your total outflows is allocated to taxes. The ThinkOut dashboard is your financial activity screenshot and contains data from the last 6 months of activity.

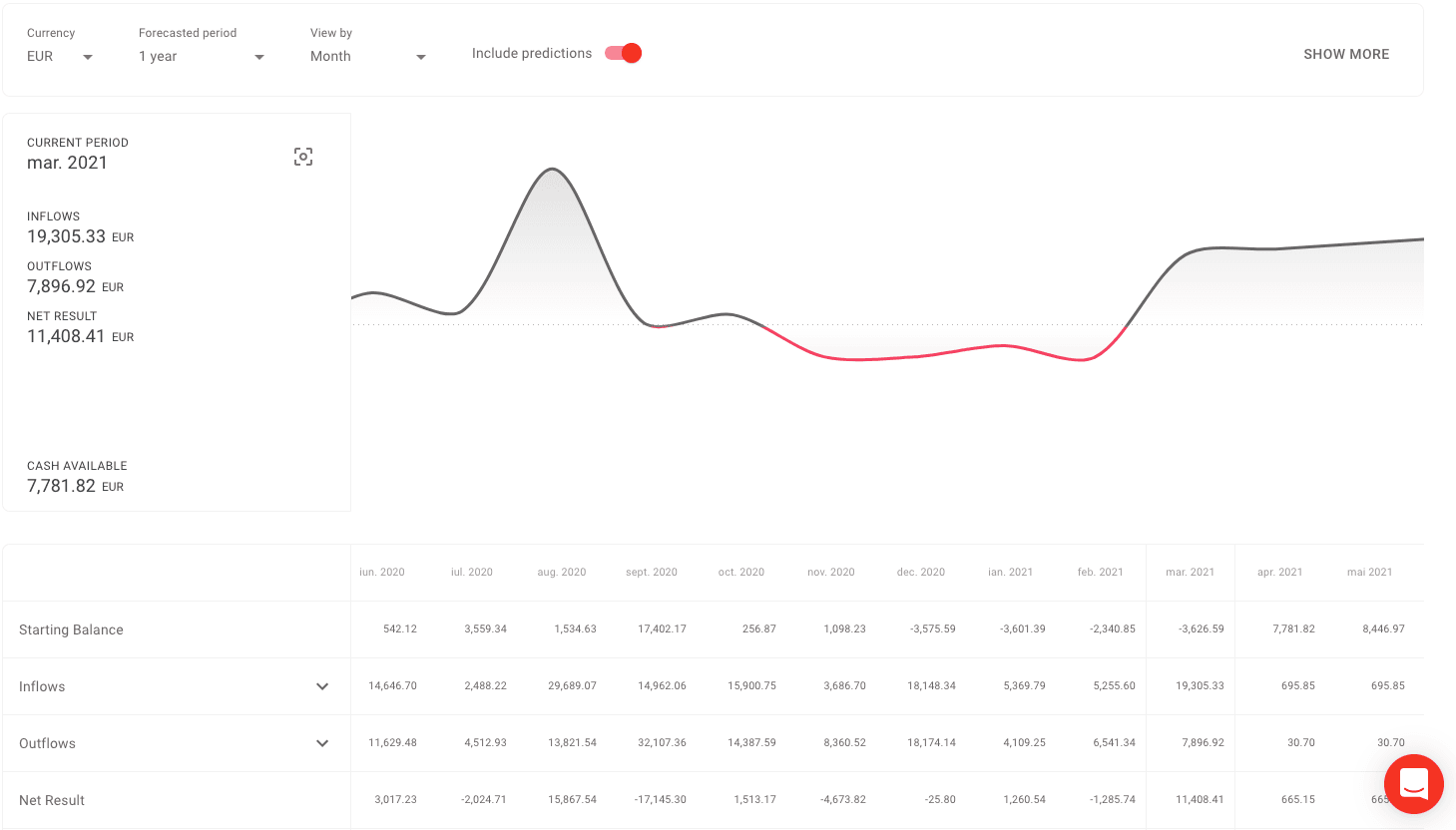

If you need the whole financial history instead, go through the cash flow plan and easily spot your peaks and troughs. See your cash flow movements for each particular project or for the entire company and easily visualize all transactions for each month.

Start planning your next moves

Your financial history and current available cash is a solid groundwork for your cash flow forecasts. And because you know your business best, ThinkOut will require your input here.

Specifically, what you’ll need to do? Add all your expected inflows and outflows for the next short term or long term period. ThinkOut helps you to do this quickly. For example, you may choose to import a list of all your A/R and A/P (invoices) that will be used as predictions or to use the details from previous transactions in order to add monthly fixed costs with a couple of clicks.

Set up your cash flow forecasts and ThinkOut will help you to spot potential cash problems in the future. Just look for the below the line fluctuations (red zone) and start taking action to avoid cash shortages: collect faster, pay later, contract a loan, etc.

Use ThinkOut and keep track of your daily transactions and overdue forecasts from just one place. Check the linking suggestions between forecasts and bank transactions and confirm association with just a click. This way you know how many of your predictions became reality and what you still need to collect or pay.

Create your yearly budget

If you are not yet familiar with the difference between a budget and a cash flow forecast, you can read about it from one of our previous blog posts.

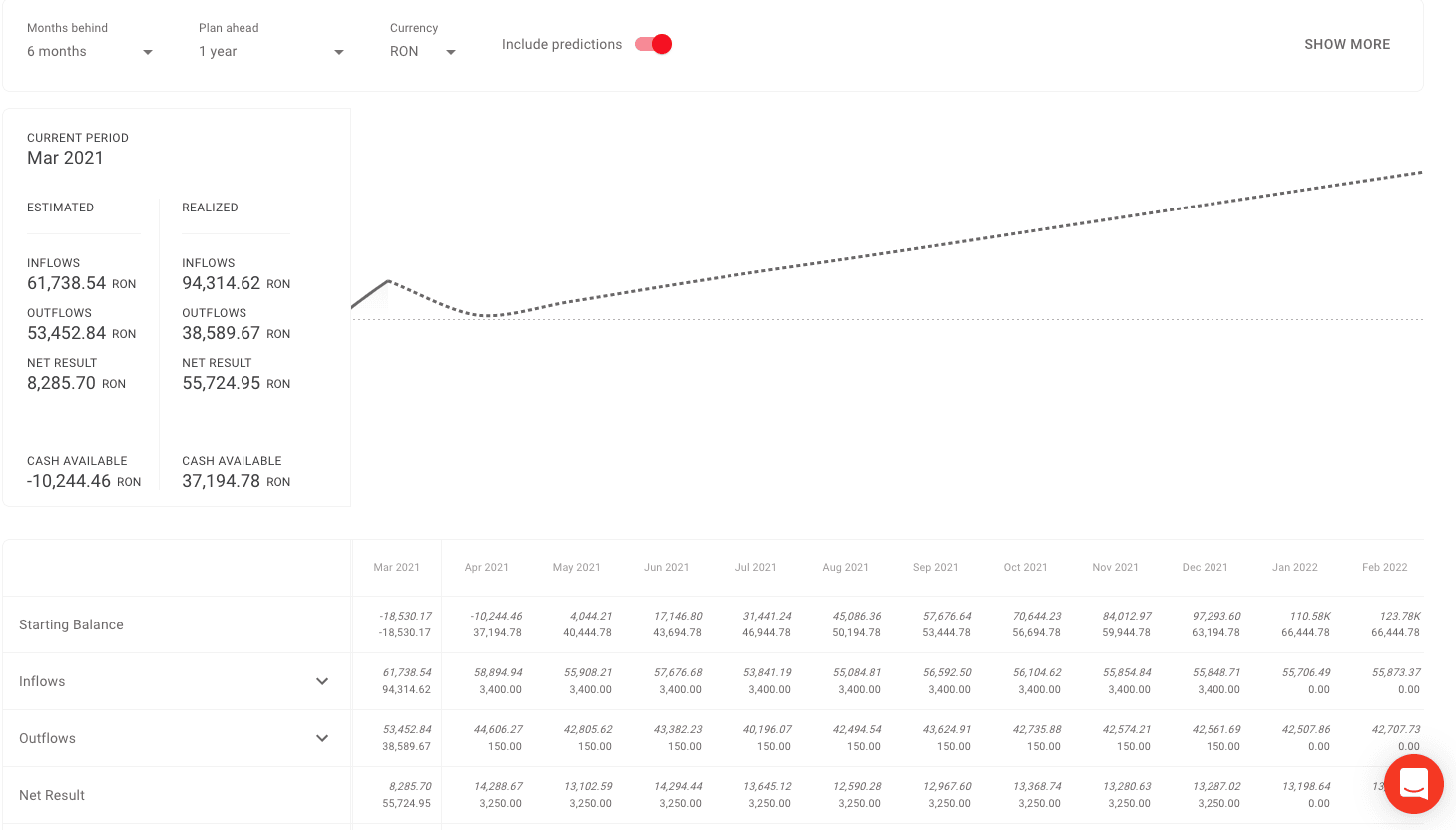

You’ll see the same distinction in ThinkOut. Therefore, we encourage you to create your budget in order to set up your monthly targets and to use cash flow forecasts to plan when and how your goals can be achieved.

ThinkOut gives you a starting point in building your budget and automatically calculates a series of estimations based on your previous financial activity. Verify it and edit the numbers to reflect the reality of your business and your plans.

Keeping track of your budget is easy as in ThinkOut you visualize estimated vs. realised numbers. This way you know where you need to push more in order to reach your goals. All your data from ThinkOut can be easily downloaded in case you need it.

Your company’s cash flow is the most reliable source of data which you can use to take informed business decisions on time. For any questions about ThinkOut, please contact us at support@thinkout.io.

Take ThinkOut for a spin

Manage your cash flow with an easy-to-use platform for busy entrepreneurs

Sign up todayShare this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Keep reading

See how ThinkOut can help your business

Cash flow, Product features

TO #1 How to set up and maintain a budget for my business?

Setting up your budget shouldn’t be a headache, even though you prefer to do anything else but financial analyses and planning.

April 28, 2021

Read more

Cash flow, Product features

TO #2 How to easily track my business expenses?

Keeping track of your business outflows is as important as monitoring your cash collections.

May 20, 2021

Read more

Cash flow, Product features

TO #4 How do cash flow activities help my business?

Your cash flow is your daily reality check. Keep a close eye on it to make sure to have quick answers to essential questions.

September 14, 2021

Read more