Cash flow, Product features

TO #2 How to easily track my business expenses?

May 20, 2021

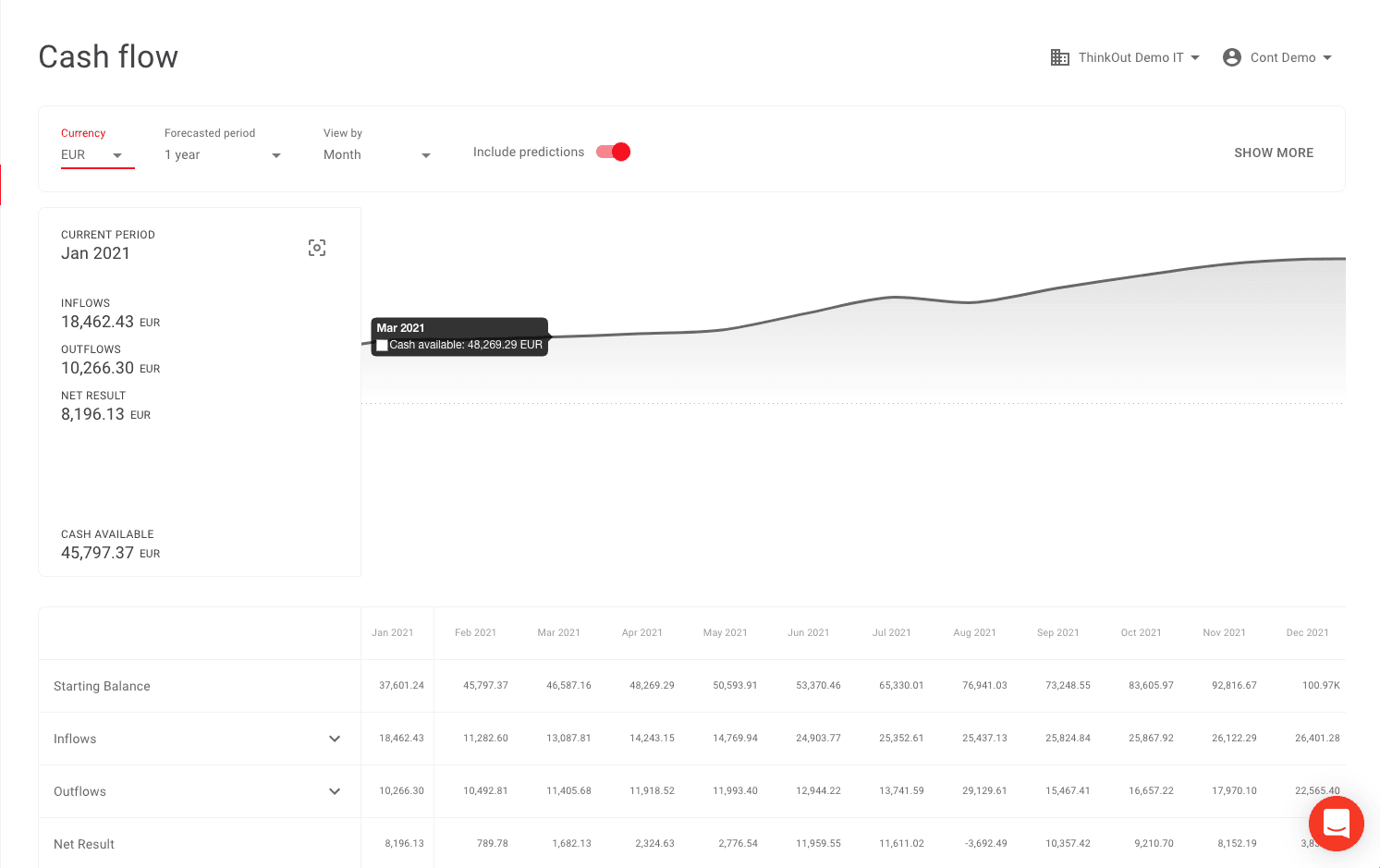

Keeping track of your business outflows is as important as monitoring your cash collections. Turn it into a habit in order to gain more control of your cash fluctuations over time and have updated data about your current cash available.

Need a fast answer to questions like Do I have enough money to pay all my bills this month? Stay on top of your spendings and make sure you understand your business from a financial perspective.

The management of your inflows and outflows is faster and easier in ThinkOut, the cash flow management platform for entrepreneurs.

What do you have to do?

-

Connect your bank accounts in ThinkOut. If your bank is currently not supported, import Excel files. Download your bank statements from your internet banking platform and upload them in ThinkOut.

-

Import your transactions from the last months.

-

Verify and confirm the automated categorisation of your imported transactions.

-

You can choose to edit and configure your category structure based on your specific business needs so it will be easier to track your top costs month by month.

-

Analyse the last transactions imported in ThinkOut in order to have an overview of your current financial situation.

-

Start planning your future inflows and outflows to check if you have enough money to cover the next operations.

-

Match your cash predictions with actual transactions from your bank account. ThinkOut will help you to keep an eye on your overdue forecasts so you don’t have to check the invoices all the time.

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Read our blog

More articles from ThinkOpedia

Cash flow, Product features

TO #1 How to set up and maintain a budget for my business?

Setting up your budget shouldn’t be a headache, even though you prefer to do anything else but financial analyses and planning.

April 28, 2021

Read more

Cash flow, Product features

TO #3 Should I hire or should I outsource?

Are you ready to hire someone new? Is it better to outsource? Do you have enough cash to afford any of these options?

June 17, 2021

Read more

Cash flow, Product features

TO #4 How do cash flow activities help my business?

Your cash flow is your daily reality check. Keep a close eye on it to make sure to have quick answers to essential questions.

September 14, 2021

Read more