Entrepreneurship

Why are liquidity ratios important for a small business?

June 24, 2020

If you’re an entrepreneur, financial information should be always at hand and you should consider it one of your best friends when it comes to managing your business.

Financial information is usually scattered in many directions and the ability to understand the data from your company’s financial documents is crucial. Unfortunately, documents like the balance sheet or the income statement don’t offer you a complete overview of your business which is why you should take into consideration using financial indicators and ratios.

Financial KPIs matter

Financial indicators are used for measuring the performance and position of a company compared with other businesses in the same field or with previous periods.

If you want to find out more about the overall health of your business, you have to start measuring and tracking progress in essential areas of company performance using certain KPIs. One of your long-term goals should always be the steady sustainability of your company’s operating model and increasing your business’s value as an investment.

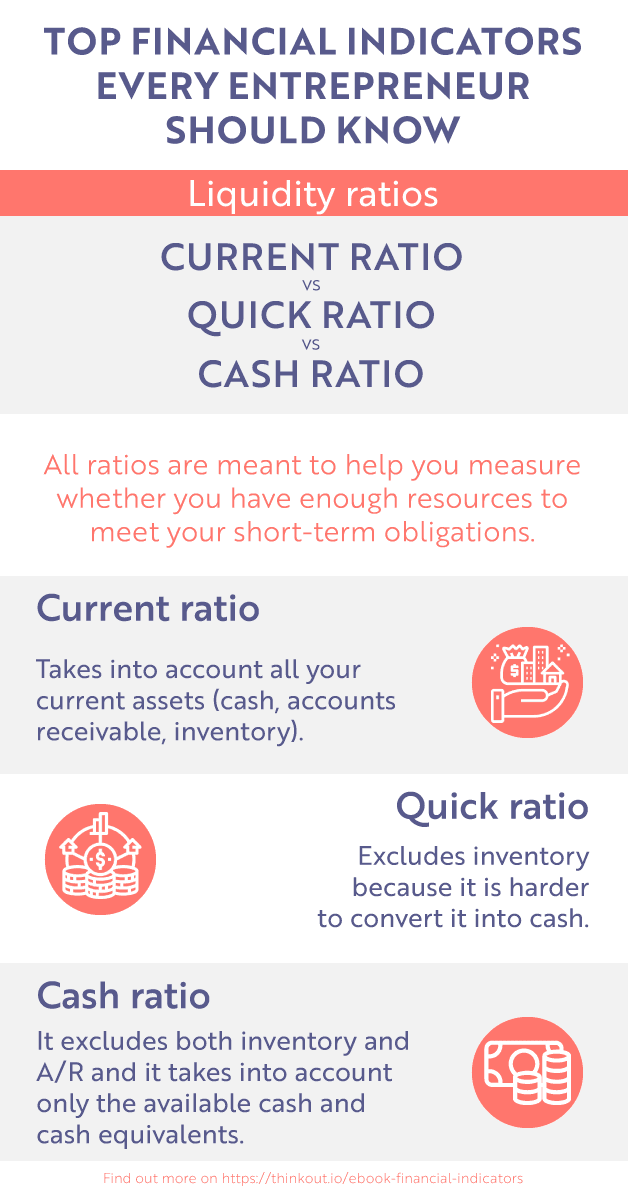

Liquidity ratios are particularly important as they help you to always be aware if your company can pay its current financial obligations, such as salaries, utility bills, suppliers, taxes.

They are especially relevant for small companies that are more prone to lack of liquidities. However, this does not mean that the big players should avoid it. The bigger the company, the higher the need for cash and the risk.

Current ratio

The current ratio is a liquidity indicator which measures the company’s ability to pay all its current debts (liabilities) by using the current assets (those that can be easily converted into cash). Some examples of liquid assets are cash available, accounts receivable, and inventory.

You can calculate the current ratio by using this formula:

Current ratio = Current assets/ Current liabilities

If the current ratio is lower than 1, it’s possible that you will not be able to pay all your current liabilities with your current assets. Therefore, a value close to 1 or higher is desirable for almost every industry.

More explicit, this means that you can only pay once all your liabilities with the available current assets. If your current ratio is 2, then the amount of assets is double compared to your liabilities. Another way to say it is that for every 1$ you owe, you own 2$ that you can use to pay.

However, a value that is too high is also something that you will not want. A high current ratio can mean that the company is not efficiently using its money for new investments, has too much inventory which ties up capital, or that it does not pay dividends to its shareholders.

Learn to make business decisions with ease

Download our latest ebook for freeStrike a balance

In order to keep your company healthy and growing, you need to establish a balance between current assets and liabilities. If you want to start setting goals regarding your current ratio, you should take into account:

✓ how much cash you need in order to pay all your current debts (monthly installments, suppliers, salaries, etc);

✓ what is the amount of inventory you need for the next period of time;

✓ what new investments you need to make and what is an approximate amount of money you need for the next period.

Keep in mind that the balance sheet is a dynamic financial statement. This means that every time you make a transaction, the balance sheet changes too and this can also influence your liquidity ratio.

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Read our blog

Learn more about cash flow management

Entrepreneurship

Profitability ratios are important and here is why

Find out more about your business’ profit and profitability so you can leverage all that information to your advantage.

July 16, 2020

Read more

Entrepreneurship

Here is how you can find out how productive your business is

Making business decisions means more than a gut feeling. It takes the right interpretation of data and what you’re doing with it.

July 24, 2020

Read more

Cash flow

How to organize your cash flow plan

A cash flow plan will give you an overview of all your revenues, expenses, and the net result over a specific period of time.

October 19, 2020

Read more