Entrepreneurship

Profitability ratios are important and here is why

July 16, 2020

For owners of small businesses, an understanding of various financial indicators and ratios is crucial, especially when business growth is the main objective.

There are many types of financial KPIs that should be taken into consideration by an entrepreneur, each and every one having its particular relevance in the success of the business. And talking about success, one of the key aspects business owners have to focus on is making a profit so they keep growing their business. A very useful thing to do as an entrepreneur is to find out more about your business’ profit and profitability so you can leverage all that information to your advantage.

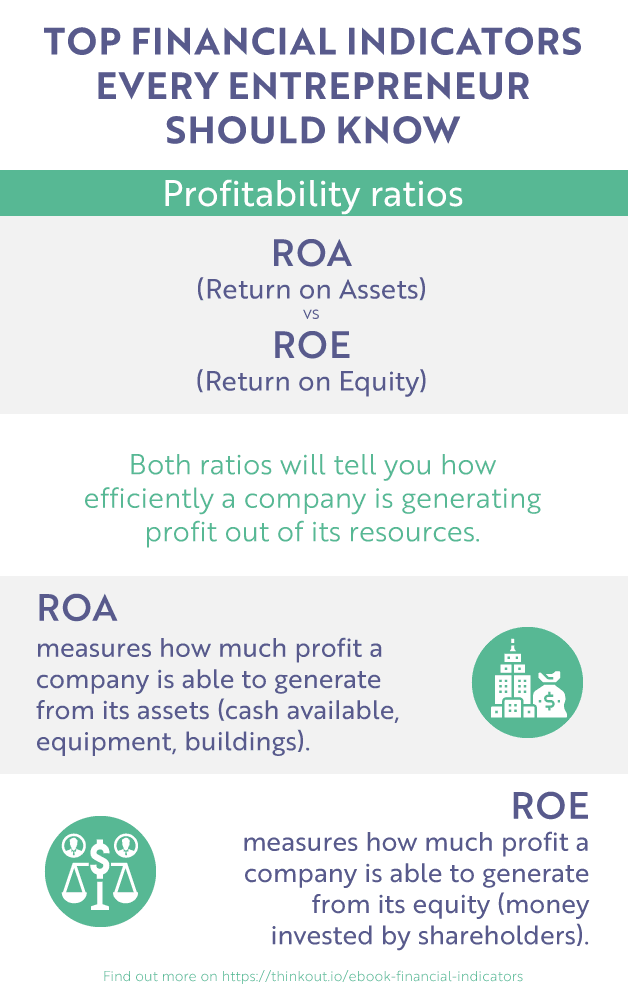

Profitability ratios will help you to understand more about your company’s ability to generate profit.

Profitability ratios are numerous, split into various categories, and help to provide useful insights into the financial well-being and performance of the company.

Let’s take return on equity as an example, which is a profitability ratio that measures how efficient a company uses the capital invested by its shareholders in order to generate profit.

How do you calculate return on equity?

*ROE = (Net Profit / Average shareholders equity)100

The higher the ROE, the more profitable is the investment made by the shareholders. This is something that every investor wants, thus the popularity ROE has gained.

However, as in most cases, ROE should not be the only indicator used to make business decisions. For example, a company can raise the value of its net profit not by increasing the shareholder’s equity, but by contracting loans. This will positively influence ROE, but it does not mean that the shareholders will receive higher amounts of dividends.

On the other side, a too high ROE could point out that the company is not used at its maximum potential (money is spent on dividends rather than on operations).

Find out how to use the most important profitability ratios

Download our ebook for free

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Keep reading

Learn more about how can cash flow management help you and your business

Cash flow

Profit and Cash Flow: Key differences

Keep an eye on both your profit and cash flow and fully understand the distinction between them.

April 09, 2021

Read more

Entrepreneurship

Here is how you can find out how productive your business is

Making business decisions means more than a gut feeling. It takes the right interpretation of data and what you’re doing with it.

July 24, 2020

Read more

Entrepreneurship

How much debt is too much for your company?

To find the answer to this question, leverage ratios will come in handy, as they offer valuable information about your company.

November 02, 2020

Read more