Cash flow, Product features

TO #3 Should I hire or should I outsource?

June 17, 2021

Are you ready to hire someone new? Is it better to outsource? Do you have enough cash to afford any of these options?

You probably identified the need of a new employee and believe that this person will bring the boost in sales your business needs. But a new hire also means a significant amount of financial risk you need to assume.

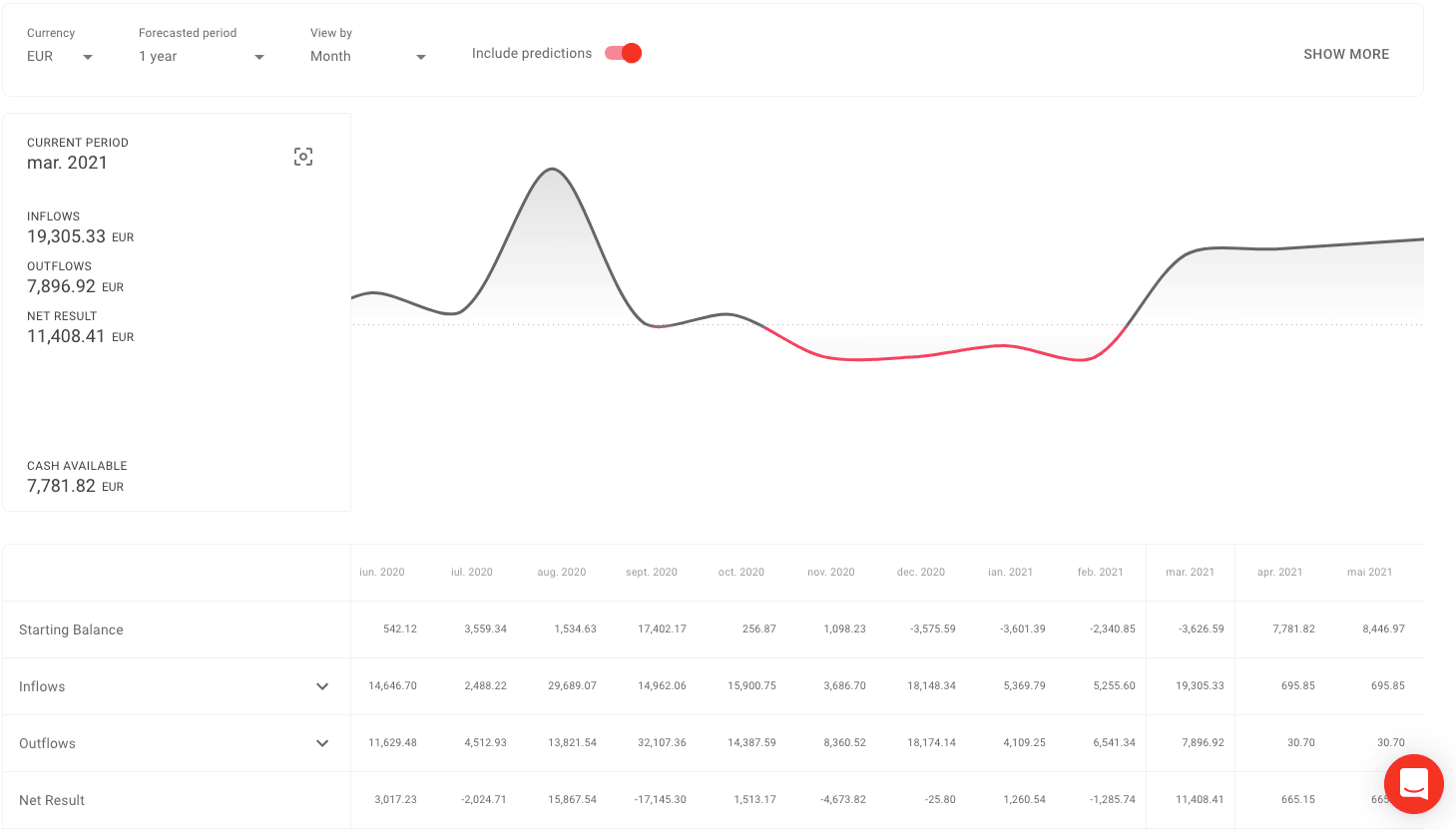

No matter if this is the first human on board or you seek to grow your already established team, always check your cash flow prior to taking such a decision. Make sure that your income is stable enough to sustain the new outflows incurred (e.g. salary, contributions, bonuses) and verify all possible scenarios (e.g. hire vs. outsourcing).

Take ThinkOut for a spin

Check out your company’s cash flow and make sure you have enough cash to keep your company afloat

Try it for freeBy applying this strategy you’ll find the perfect timing for your company to bring more people aboard. And in this situation a real financial overview of your current finances and cash flow movements for the next 3-6 months will really come in handy. If your cash flow over time is stable, if you can cover all your current costs and you do not identify any cash gap in the foreseeable future, then probably it is a good time for a new employee.

Always forecast your next money movements, understand what money you can count on in the near future, what are your expected payments and take informed business decisions regarding the expansion of your team. Consider using ThinkOut, the cash flow analysis and forecasting platform for entrepreneurs.

Connect your bank account, import and daily refresh your transactions automatically and start planning the future of your business. Build a healthy business and avoid cash flow crises with ThinkOut. Completely free for the first month of trial.

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Read our blog

More articles from ThinkOpedia

Cash flow, Product features

TO #1 How to set up and maintain a budget for my business?

Setting up your budget shouldn’t be a headache, even though you prefer to do anything else but financial analyses and planning.

April 28, 2021

Read more

Cash flow, Product features

TO #2 How to easily track my business expenses?

Keeping track of your business outflows is as important as monitoring your cash collections.

May 20, 2021

Read more

Cash flow, Product features

TO #4 How do cash flow activities help my business?

Your cash flow is your daily reality check. Keep a close eye on it to make sure to have quick answers to essential questions.

September 14, 2021

Read more