Entrepreneurship, Cash flow

How to use cash flow forecasts to get a loan

August 30, 2021

In an ideal world, the environment in which we work and develop companies would be stable and predictable, but in real life every entrepreneur has probably faced at least once a business crisis. It’s not always easy or even possible to foresee where your company is headed. However, a forecasted overview of your company, even if it’s an estimation, can bring a lot of benefits for the business itself and for you, as a manager.

If monitored periodically, financial planning offers you an overview of what is going to happen in your business. You’re not surprised anymore when something is not working the way it is supposed to be and gain time to prepare in advance. You set up realistic business goals and your team knows its aim. You convey transparency, maintain focus and gain more control over tomorrow.

Financial forecasts are built on various business indicators as each entrepreneur is measuring what is important for the company. Not sure where to start from? Perfectly normal if you haven’t done this before. Don’t postpone it too much and start working on a financial plan for the next months. Let’s take it step by step.

Understand the past in order to create tomorrow

Have a look at your financial history, ideally for at least one year. Check how the money fluctuated over time and try to remember which factors determined your best months and the rainy ones as well. This type of exercise will give you insights regarding any activity patterns that your company is going through. For example, if you own a restaurant, there’s a possibility that you are more productive during summer or Christmas break. If you know this in advance, then you may consider saving some cash upfront in order to keep you going during the rainy season.

Prioritize your plans

Make a list with all the next investments. Take into consideration any new equipment you want to buy, additional hires or that cool teambuilding you’ve always wanted to have. Do the math for every point on your list and approximate the total cost for each. Next you’ll have to check if you have enough available cash in order to make all the investments you plan.

Understand how money moves your business

ThinkOut gives you the information and tools to measure your business's financial health.

Try ThinkOut for freeWork on your budget

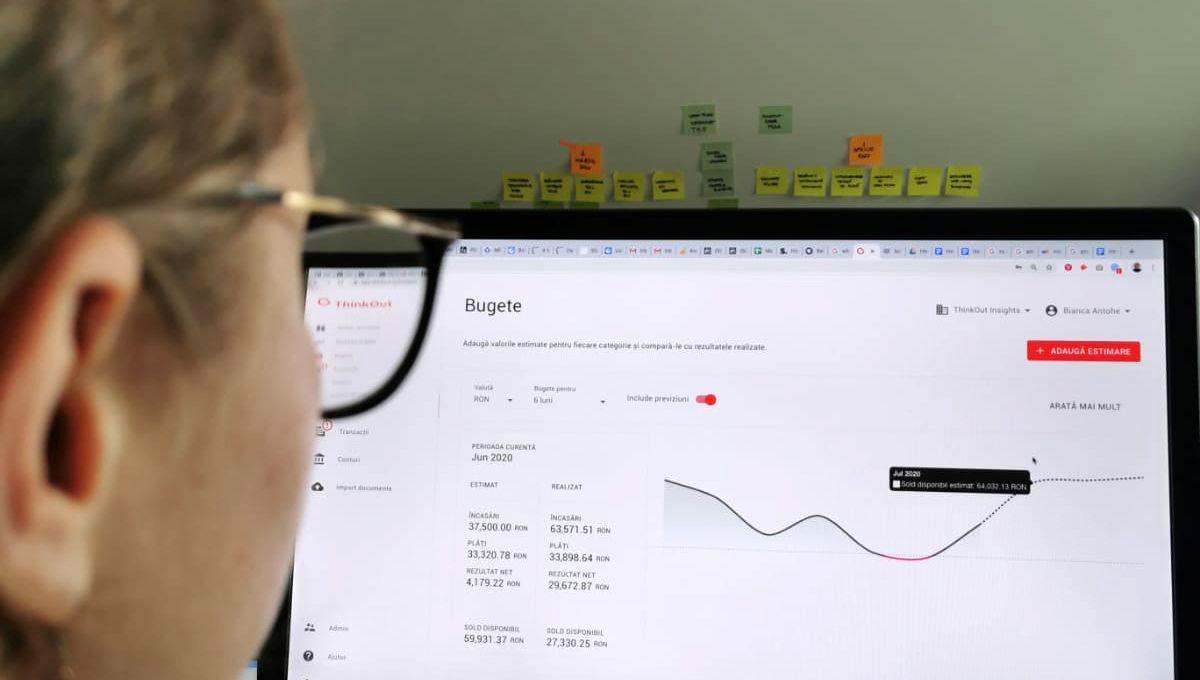

Start creating your budget for the next 3-6 months. You can choose a longer period if you feel comfortable with it, but keep in mind that the closer you look, the more accurate the data. The budget reflects your estimations regarding the next incomes and expenses that your company expects. Nothing complicated, just think about your main categories of inflows and outflows and try to set a goal for each of them. If you closely followed the steps in this article, then you also have access to your financial history. This may become the groundwork for your budget. Read more about how to create and use budgets in your company.

Include cash flow forecasts

Your budget represents the business objectives or more specifically, where you want to lead your company in the following period. If you need to keep a close eye on the progress towards the budget goals use cash flow forecasts. Compared to the budget, which encompasses the overall future image of your company, the cash flow forecasts give you some insights regarding the moment in which your goals will be accomplished. As cash is the reality of your business, we encourage you to include it into your planning. There are companies who look profitable on paper, but in reality they cannot pay suppliers on time. And this is a consequence of inadequate cash flow management. Carefully analyze your cash flow and build prognosis based on cash position in order to avoid any surprises.

A simple way of starting your own cash flow planning is by listing all recurring payments which happen regularly. Make sure you include here the rent, utilities, salaries, taxes and so on. Compared to the budget, where estimations are set at a month level, cash flow forecasts require a more specific due date. If you usually pay rent on the 30th of each month, then you have to make sure that each last day of the month you have the necessary amount of cash to fulfill this obligation.

Go on with your planning by adding any other foreseen payment which is not recurrent. Some examples are advertising costs or a project you plan on starting with new suppliers. Follow the same rule and set a specific date for each forecast in order to approximate your cash position over time.

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Keep reading

Find out more about cash flow forecasting

Cash flow

Budgeting vs Cash Flow Forecasts

Use budgets and cash flow forecasts in order to establish your business' direction.

March 18, 2021

Read more

Cash flow

Why is cash flow forecasting important

A cash flow plan helps you understand your decisions' impact on the company’s cash position.

December 18, 2020

Read more

Cash flow

How to build financial forecasts for your business

Know where you’re headed by building forecasts of your inflows and outflows.

September 29, 2020

Read more