Cash flow

How to build financial forecasts for your business

September 29, 2020

As a small business owner, there is always the chance that things won’t go as planned. However, this doesn’t mean you should get beaten down or discouraged. Before you take any kind of decision regarding your business evolution, you have to know where you’re headed and a good way to get more perspective on this is to make forecasts of your inflows and outflows.

Check both previous results and current situation so you can make reasonable forecasts, and the patterns you’ll be noticing will help you to understand what choice to make, why you’re making it, and what impact it has on your business.

How to forecast the revenue

Forecasting your revenue may seem pretty difficult, but if you have a clear record of your income and expenses you can build a reliable plan to grow your business.

The easiest way is to divide the products you sell into categories and once you have done that, estimate the sales volume by multiplying the number of units by the selling price, for each month.

Let’s say you own an artisanal bakery in a residential area and the most profitable category of products is the éclairs. You’re estimating that in October you will sell 1200 éclairs, the price of a single product being 9 USD; 1200 éclairs x 9 USD = 10,800 USD. Therefore, in your cash flow plan, the October revenue projection for the Éclairs category will appear to be 10,800 USD.

As time goes by, take a look at the difference is between the inflows you projected and the ones that actually took place. Are there certain patterns that repeat? At what time of year? What are the differences? Are they significant? Can they be correlated with certain events that take place in the local or global economy? Depending on the differences between the forecasts and the transactions made, you can adjust the following forecasts with the same percentage increase or decrease.

What should you consider when making your income forecast?

Past financial results

The first place you need to look when making financial forecasts is, ironically or not, the past. Review all the financial data so you can build predictions, see what the patterns are, ask yourself questions like “How many sales did I have last month?” or “How many sales did we have in the same period last year?”. You may not have financial expertise, but you are the person who knows his business best. By looking at these patterns, you can make assumptions that come close to the real situation, and if you know what your company’s growth rate has been so far, you can get a pretty clear idea of how much and how it will further grow.

Sales trends

Currently, your sales may be growing at a steady pace, but this situation could change quite quickly because there is an unlimited number of factors that can affect your business. Consider market changes, semestrial or annual economic trends, business seasonality, or other key aspects that are strictly related to your business: promotions, discounts, expanding the range of products/services.

Other businesses’ situation

The financial information of other similar companies can be useful to you when forecasting revenue streams. You can see where you stand – if you are above or below the industry average – this practice can be helpful especially if you have just set up your company and do not have previous financial records on which to base your projections.

Forecast your income streams with ease

Try ThinkOut for freeHow to forecast expenses

In order to have a complete image of your company, it is necessary to take into account all the expenses within the company.

An expense forecast means estimating costs over a period of time which may vary depending on the accuracy you are looking for. Expenses may include production costs, office rent, utilities, marketing, employee salaries, taxes, interest, bank fees.

As sales grow, so do the direct costs that go into developing the products or services you offer. The more you sell, the more you have to spend to keep up with your company’s operations.

Calculating forecast sales and direct expenses will help you determine the profitability of your business.

The forecast of the costs of the goods sold is similar to the sales projection: it estimates the number of units you will sell, then multiplies the number of units by the direct expenses needed to produce them. If you produce custom T-shirts, expect to sell 100 pieces and the cost per unit is 10 USD, this means a forecast of 10,000 USD in direct expenses.

Review and update forecasts

When it comes to building revenue and expenses forecasts, expect to do a lot of revisions. Keep in mind that not all forecasts will really take place, so your projections need to be adaptable. It is recommended to keep some money aside for any unforeseen situations.

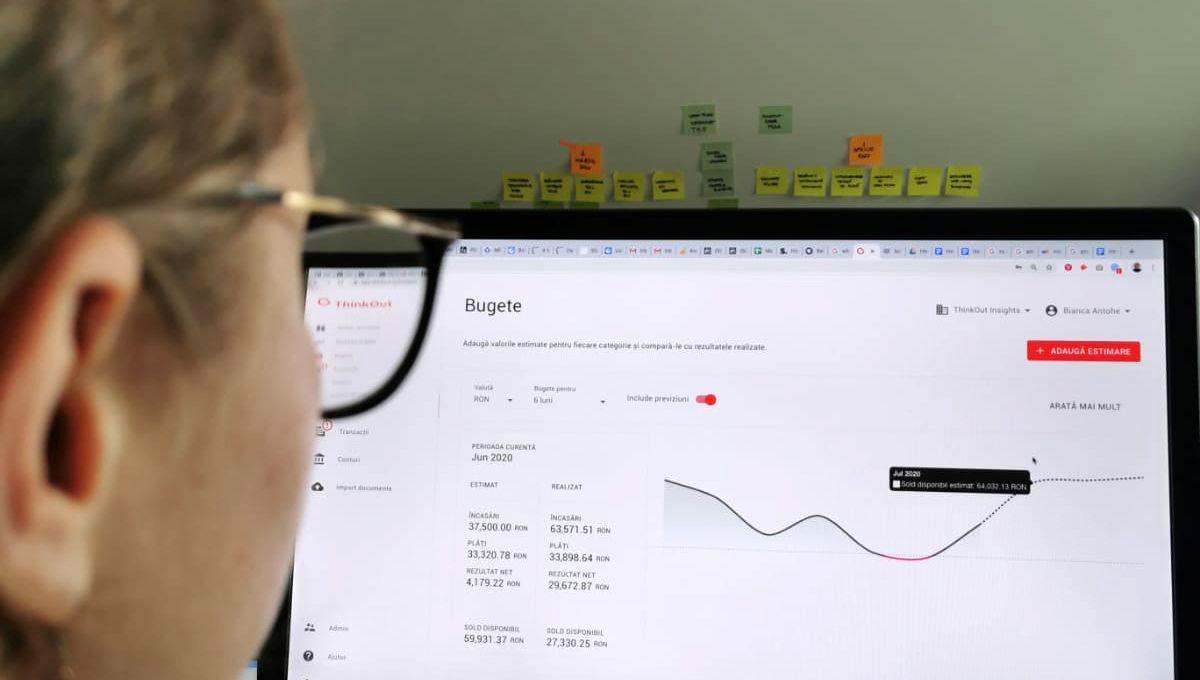

With ThinkOut you can easily add inflows and outflows, edit details whenever you need, see what your business will look like in the next 3-6 months and how long it will last depending on your planned future.

Remember that income and expenses forecasts guide the direction your business can go, but that doesn’t mean they have to be 100% accurate. Once you have started making predictions, adapt them to the current situation, and use them to make informed decisions to grow your business healthily.

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Read our blog

Learn more about cash flow management

Cash flow

Budgeting vs Cash Flow Forecasts

Use budgets and cash flow forecasts in order to establish your business' direction.

March 18, 2021

Read more

Cash flow, Product features

How to use ThinkOut for cash flow management

Your cash flow is your company’s financial health indicator and you probably already know how important it is to carefully monitor it.

March 10, 2021

Read more

Cash flow

Why is cash flow forecasting important

A cash flow plan helps you understand your decisions' impact on the company’s cash position.

December 18, 2020

Read more