Cash flow

How to Do Cash Flow Planning When You're Just Starting Out in Business

March 17, 2025

When you're just starting a business, financial forecasting becomes a priority. You may have heard of this concept before without understanding what it involves, or perhaps you've already tried to do it without success. But the question remains: what exactly is cash flow planning and, more importantly, how can it help me and my business?

Well, although it might seem like a complicated process, it doesn't have to be. Simply put, cash flow forecasting helps you gain a clearer picture of your business’s future based on your incoming and outgoing payments. When building your forecasts, you need to consider invoices, loans, expenses, and sources of revenue.

Imagine always knowing whether you'll have enough money to pay all your bills at the end of the month – it's a nice feeling, right? Well, forecasting can provide that sense of financial security much needed in entrepreneurship.

Let’s take an example: a newly launched online shop selling handcrafted soy wax candles—a business started out of passion with the goal of generating extra income alongside a full-time job.

Short-term forecasting

Short-term forecasts are essential for understanding your business’s current and near-future cash flow. This typically involves analyzing transactions and invoices over the next 1-90 days. In ThinkOut, you can add both one-time and recurring forecasts to get a complete view of your cash flow, taking these pieces of information into account.

Start with fixed expenses

What you can consider for fixed expenses:

- estimating monthly operational costs, such as raw materials (wax, wicks, fragrances), packaging, delivery costs, and subscriptions (hosting services, internet, etc.).

- if you work with a social media management agency, you can add the amount you pay them monthly to forecast promotion expenses.

- estimating potential returns based on the history of returned orders (if any), so you're prepared for possible cash flow disruptions.

Continue with estimated revenue

When it comes to planning income, you can:

- add sales estimates based on seasonality – for example, there may be increases during winter holidays, Valentine's Day, March 1-8, or other special events. This way, you can adjust your marketing campaigns to maximize sales.

- forecast sales based on conversion rates from previous campaigns. If you know that 5% of website visitors place an order, and an online ad attracts 1,000 visitors, you can estimate how many sales you'll have.

- calculate the revenue generated by discounts if you run discount campaigns, then analyze whether these strategies bring enough profit.

Start forecasting your inflows and outflows with ThinkOut

Sign up for a free trialLong-term forecasting

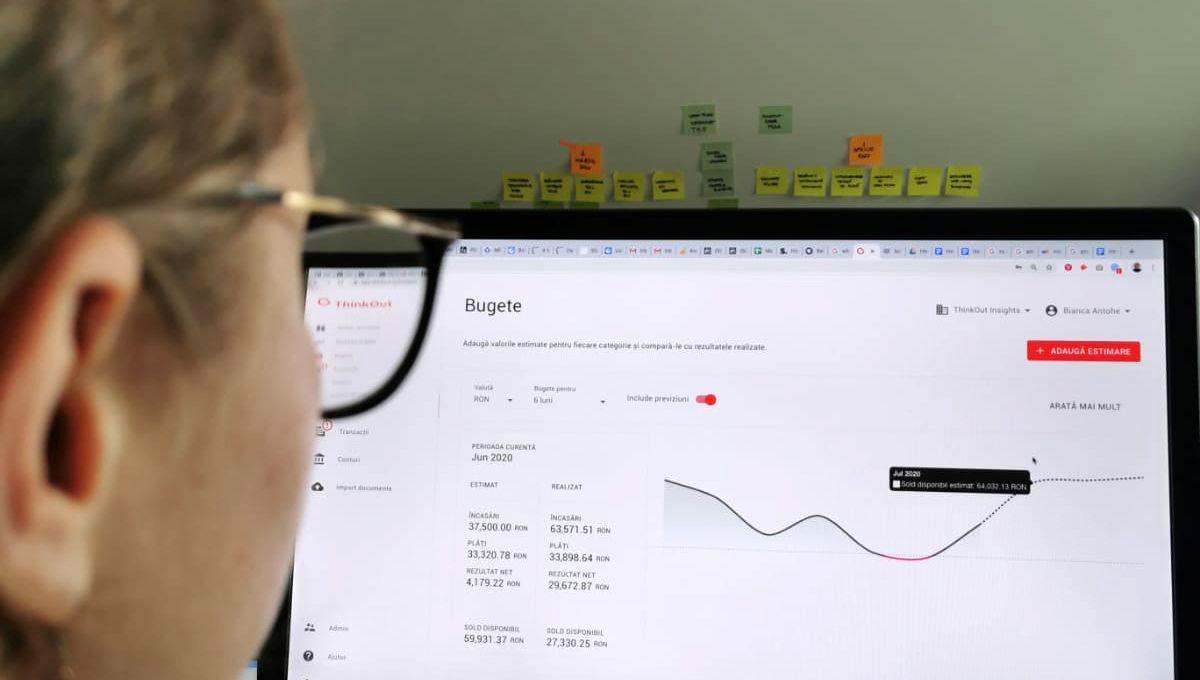

Once your short-term forecasts are in place, it’s time to think about the future. Long-term planning typically covers 6-12 months or even up to 2 years and is useful for strategic decisions, such as business expansion. You can also create budgets and “what-if” scenarios to set financial goals—this can be easily done with ThinkOut, the financial management tool designed for small and medium-sized businesses.

Long-term expense forecasting

When it comes to expenses, you can start with:

- estimating long-term costs for purchasing raw materials, considering possible price fluctuations and supplier relationships.

- preparing for possible tax changes or new taxes that could affect profit margins.

- planning investments for business development, such as a new website, production equipment, or renting a space to open a physical shop.

Long-term revenue forecasting

For a business with artisanal products, this can mean:

- projecting annual sales growth, analyzing historical trends and campaign data about acquiring new customers (if you can't manage on your own, you can contact a specialist to help you interpret the data);

- launching new product collections, such as customized candles, gift sets, or limited editions for special events;

- expanding to international markets if you notice demand for your products outside the country.

Whether you focus on short or long-term, financial planning will help you avoid unpleasant cash flow surprises. Use a dedicated management tool like ThinkOut, that can help you make informed business decisions. 🚀

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Read our blog

Learn more about cash flow management

Cash flow

How to build financial forecasts for your business

Know where you’re headed by building forecasts of your inflows and outflows.

September 29, 2020

Read more

Cash flow

Budgeting vs Cash Flow Forecasts

Use budgets and cash flow forecasts in order to establish your business' direction.

March 18, 2021

Read more

Cash flow, Entrepreneurship

How to use cash flow forecasts to get a loan

A forecasted overview of your company can bring many benefits for the business itself and for you, as a manager.

August 30, 2021

Read more