Cash flow

Who’s afraid of cash flow planning?

May 16, 2016

All right, we’ve all come to the conclusion (so far) that cash flow is really important to any business, but mostly for small ones. Without a doubt most entrepreneurs and managers are well aware of that; and not since yesterday, but for quite some time.

So why do we keep talking about its importance?

It’s easy: everybody knows the theory, but few people actually apply it. Why is that? Because it is time-consuming and annoying. There, we’ve said it. No one pretends it is a great, enjoyable activity (though it may become with the right tool). It involves paying daily attention to a lot of details and seeing a not so bright future materializing in the shape of a downgoing curve. The very thought of it gets you cold shivers on the spine. However, theory says that we need to face our fears in order to evolve, so let’s take a quick look at what makes cash flow the monster in the closet that nobody wants to look at.

Tedious work

A good cash flow management implies a good control of all the cash income and outcome. This means entering values, no matter how small, in a table on a daily basis, making sure you don’t miss something that will add up in time and cause false predictions. You need to take into account that even those transactions or currency change fees are important and need to be counted. They may seem insignificant, but with a good amount of transactions per month, the sum should not be ignored. Also, consider those small expenses: tea, coffee, sugar, anniversary cake once in a while….you probably tend to ignore them, pass them as too little to matter; you couldn’t be more wrong.

Every penny matters, especially when it adds up, notably when your income is not as you predicted and the Zero Cash Day may be closer than you thought. So yes, entering all those details all the time is no fun.

What to do about it?

Choose a tool that allows multiple users and recurrent transactions; this way you can delegate the daily cash flow update and set values that will automatically repeat at a certain date (if the value stays the same).

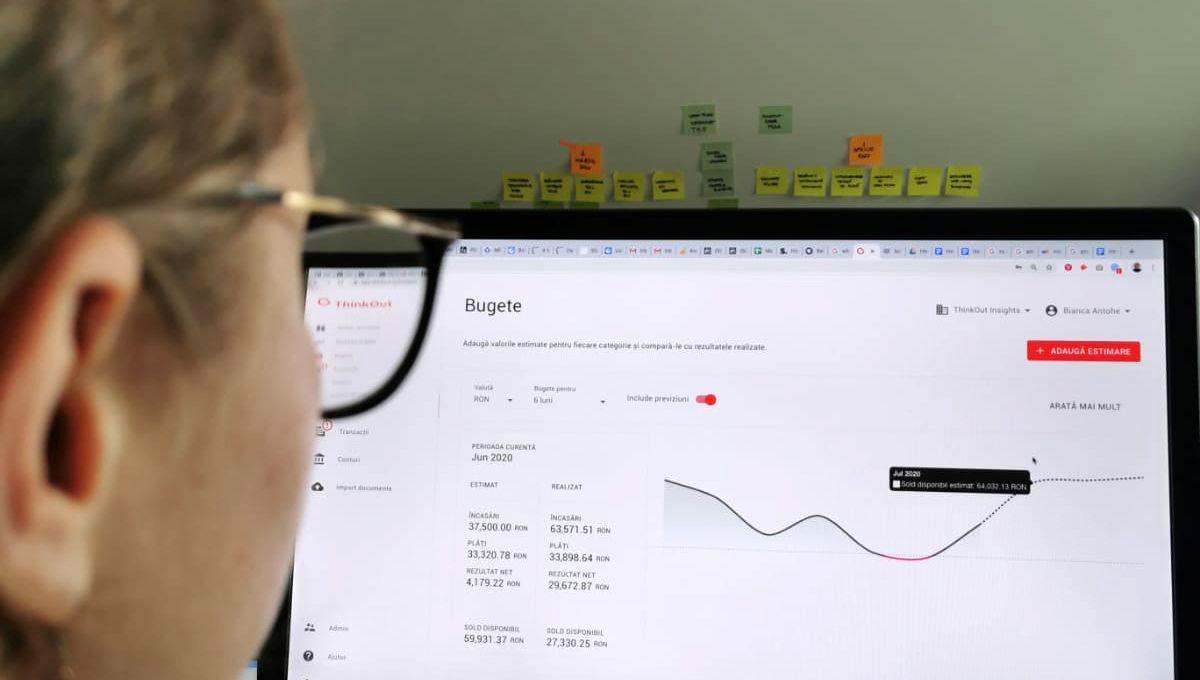

Take ThinkOut for a spin

Sign up for a 30-day free trialDark clouds on the horizon

Forecasting (even for the weather) means you need to face, at some point, bad news; things may go great for a while, but at some point, the smiley face is very likely to turn sad. It is not a question of “if”, but of “when”. It is that moment when the company runs out of cash and you need to find resources to pay the bills. No one is keen on facing that evidence, though everyone is aware of its imminence. Still, knowing it’s there is not as bad as actually seeing it. And a forecasting spreadsheet will do just that: point you the moment you fear the most.

So why would you want that? Because it will get you moving into taking action, to avoid exactly that day (postpone it indefinitely). It’s always better to be prepared and act in consequence than to be taken by surprise (especially by a bad one).

What to do about it?

Make sure you keep a thorough cash flow update and make predictions. Generate reports and charts based on the values you know and anticipate. You’ll get a clear image of how long until Zero Cash Day and you can prioritize payments, bill more promptly and encourage cashing in. The more time in advance you become aware of it, the more time you have to act, resulting in less stress.

It’s too confusing

Working with several bank accounts, more than one currency and different cash payments (big or small) complicates things. It is hard to keep track of all transactions, conversion costs and so on. Why would you do it? Because if you don’t, it will get even more confusing. You’ll wake up one day asking yourself where did the money go? How am I going to pay the employees? Where to get cash from to pay the rent?

What to do about it?

Stay in control of your cash flow. Monitor every payment and income, even predicted ones. Put all the data in one place: a spreadsheet or an app, whatever is more convenient to you. Just write it all down. It may seem difficult and confusing at first, but once you start, everything will become clear. All receipts and bills will get to their place and you’ll gain a clear picture of the company’s cash movements. It will bright your day. You’ll know with more accuracy what to do and when.

Now that you faced these fears and found out it is not impossible, start planning and controlling your cash flow. Don’t postpone it. It’s like going to the gym: the longer you wait, the more difficult will become in time. Find the tool that suits your style and use it to make things easier. You can take a look at ThinkOut and see if it’s right for your business.

If you have any other thoughts on this (other reasons preventing you from keeping a close eye on the cash flow), share them with us in a comment or at office@thinkout.io. We’ll be glad to learn from you and exchange ideas.

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Read our blog

Learn more about cash flow management

Cash flow

Budgeting vs Cash Flow Forecasts

Use budgets and cash flow forecasts in order to establish your business' direction.

March 18, 2021

Read more

Cash flow

How to organize your cash flow plan

A cash flow plan will give you an overview of all your revenues, expenses, and the net result over a specific period of time.

October 19, 2020

Read more

Cash flow

The hidden perils of cash flow forecasting

Small and fast-growing companies need a cash flow forecast to keep the business safe. But what about those perils?

February 15, 2017

Read more