Cash flow

“What if” scenarios

September 06, 2016

First things first: Forecasting

As a business owner, planning for the future is a mandatory thing to do. Not only for the sake of your business, but also for your own peace of mind, right? Right.

As we already know, cash flow forecasting is one of the most important things that should be done in order to keep your business on the go. It allows you to take a clear glimpse of where your cash is at the moment, to whom you owe money or where are you making the most. Thus, if you want to see how your cash balance will be next week or next month…you need to do a cash flow forecast. Not to mention that through cash flow forecasting you can set your financial goals for the next year. But it would be really, really nice if you could actually see what is going to happen, right? Right.

Scenarios. Scenarios Everywhere

This is where the ‘What-If’ Scenario part intervenes. ‘What-If’ Scenarios are a very important piece of your cash flow forecasting puzzle which helps you make confident business decisions.

This functionality is for financial occurrences that could-maybe-possibly happen and if they did this is what would happen to your cash flow. As we pointed out before, forecasting should only be for situations that you know will occur, such as office rent, salaries, and other known costs etc.

The ‘What If’ part is for scenarios like potential new sales or extra costs which are not confirmed yet. Here we talk about a manager’s assumptions, such as: “If I open a new office or make a big investment or hire new people – what would happen to my business’s cash position?”

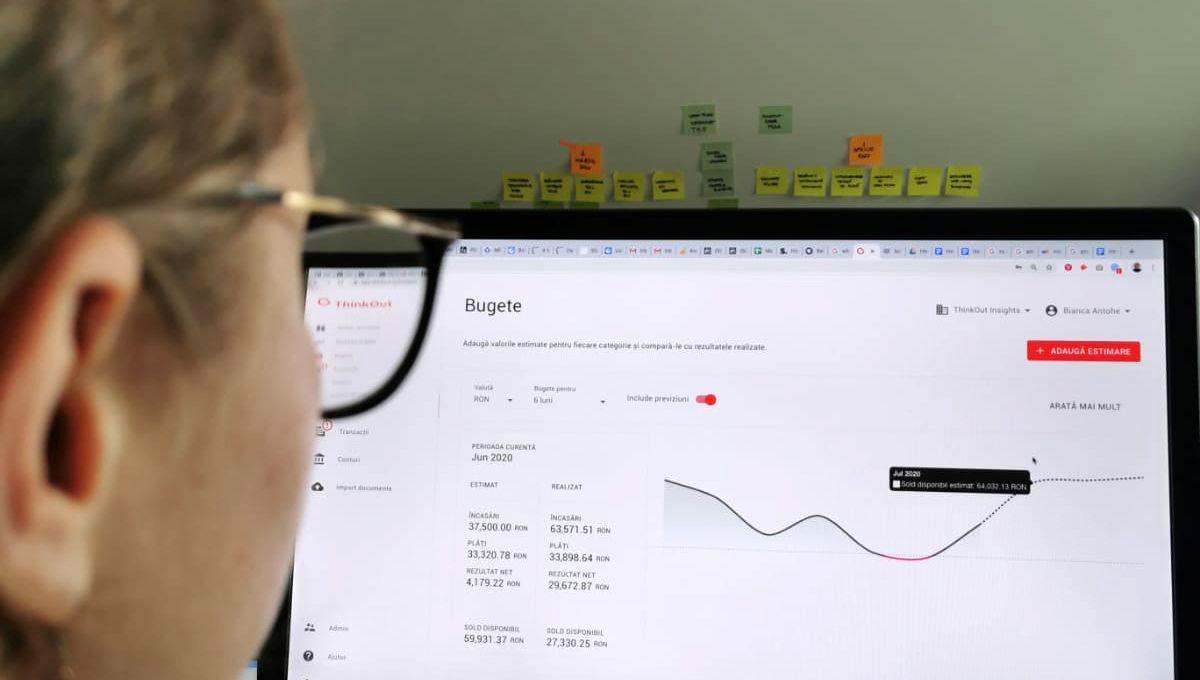

Building multiple scenarios and merging them might be a useful exercise if you have a number of different possibilities all going on at once. This way, as a business owner, you can better determine the value of an investment or business venture, and the probability that the expected value calculated will actually occur. (For instance, let ThinkOut give you a good overview)

Scenarios are a cash flow management functionality meant to improve the quality of organisational decision-making. It’s essential for running your business forward and it should be used:

• To envision a best and worst case for your business.

• When you need to work seasonal or environmental fluctuations.

• To create quick action plans to baffle short-term risk.

• To get your team to ThinkOutside of the box (couldn’t help the wordplay).

• When you want to employ more people: what’s the impact on sales and expenditure?

•When you want to expand your offices.

• When you want to take on a new untested product line (such as a digital product).

‘What-If’ Scenarios can help you to foresee unexpected threats to your business. The key is to get your team involved with the creation of the scenarios – let them take ownership upon the predictions – this way, you, as a business owner, will be able to create a good impact on the intrapreneurial spirit.

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Read our blog

Learn more about financial planning

Cash flow, Entrepreneurship

How to use cash flow forecasts to get a loan

A forecasted overview of your company can bring many benefits for the business itself and for you, as a manager.

August 30, 2021

Read more

Cash flow

Budgeting vs Cash Flow Forecasts

Use budgets and cash flow forecasts in order to establish your business' direction.

March 18, 2021

Read more

Cash flow

Why is cash flow forecasting important

A cash flow plan helps you understand your decisions' impact on the company’s cash position.

December 18, 2020

Read more