Cash flow

The art of cash flow forecasting

April 18, 2016

Have you ever wondered why most business owners don’t watch cash flow constantly? Back in 2007, a survey showed that only about one-half of business owners tracked cash flow regularly, even if business experts constantly warned about its importance. Things are no more different today, either.

What many business owners do is to just check their profit and loss tallies regularly; they think in terms of sales and expenses, not cash flow. This is a good, but insufficient approach.

Why would anyone check cash flow every once in a while, at least? Well, because this good habit allows a very useful, company-saving action: cash flow forecasting. Why is this essential? Because it predicts the first negative day, for instance, or cash flow gaps. It shows if the company stays solvent and for how long. Even profitable companies can run out of cash if they don’t know their numbers and manage the cash as well as the profits.

A good cash flow analysis can make a tremendous difference for a good business plan. All the strategy, tactics, and ongoing business activities mean nothing if there isn’t enough money to pay the bills. And that’s what a cash flow projection is about — predicting your money needs in advance, so you don’t get caught unprepared.

If this sounds too burdening, let us guide you through the “secrets” of cash flow forecasting and you’ll see how easy it can get.

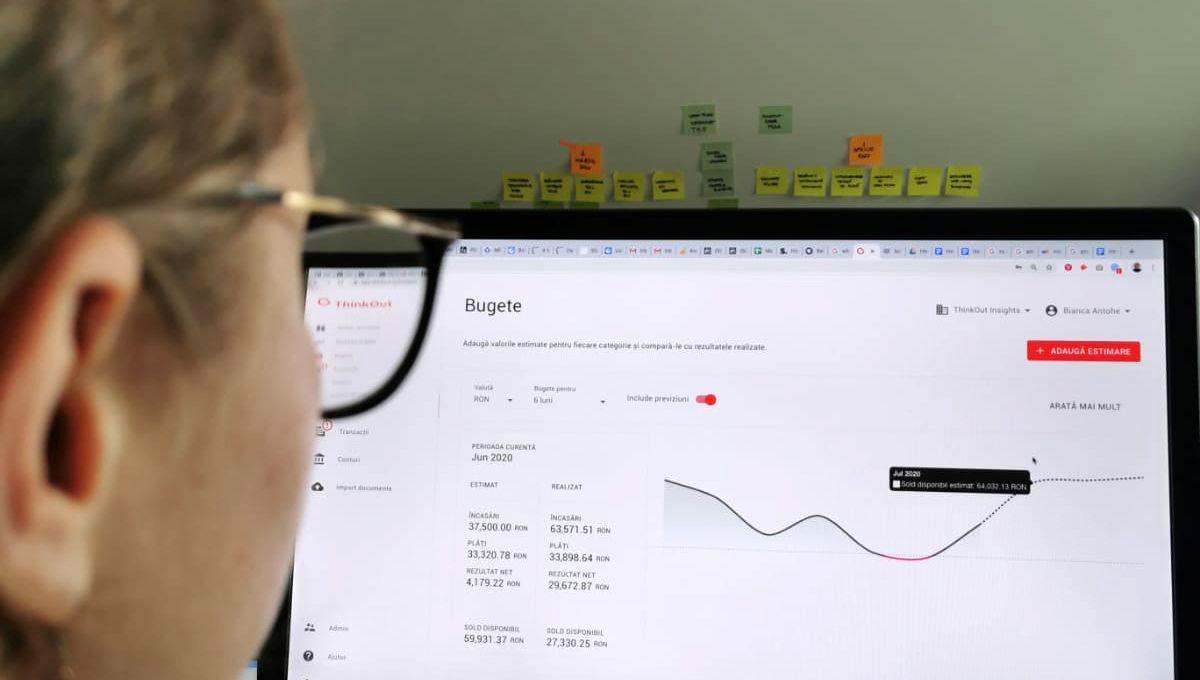

Looking for the right tool to start cash flow forecasting?

See how ThinkOut works for your businessWhat does a cash flow projection mean?

The purpose of cash flow projections is not to construct elaborate mathematical models or to predict the future, but rather to identify potential weaknesses in a given situation and point the way to adopting measures to enhance, correct and protect your business.

While statements provide details of actual results or progress, cash flow forecasts are a future prediction of the dynamic of your business finances.

To be able to build such a forecast, you need a trading history to relate to. This is why it can prove a little difficult for new businesses. At least at first. However, forecasting and making adjustments frequently will enable you to become more accurate.

There are situations when it is recommended to operate frequent forecasts (monthly or weekly): when starting your business, experiencing rapid growth or facing financial difficulties. These regular forecasts allow you to develop strategies and act to fix problems before they become major issues. Quarterly forecasts may be more appropriate for a stable, established business.

What is the use of cash flow forecasting?

Forecasting cash flow can support various business decisions. Therefore, as a business manager, you can:

✓ model a new business or project to check if it’s viable;

✓ check that you will enough cash to pay your staff and suppliers and cover operating expenses;

✓ anticipate shortfalls in cash and either plan your operations accordingly or arrange finance to cover the shortfall;

✓ determine your borrowing needs and plan for capital investment;

✓ monitor/manage stocks in order to make the best use of cash;

✓ plan investment strategies to ensure that you can earn the best possible return on spare cash.

How do you create a cash flow forecast?

There are a few steps you have to respect in order to create a good cash flow forecast.

1. Prepare a list of assumptions

Forecasts are driven by assumptions, so for it to be useful, the underlying assumptions must be appropriate to the business.

In assuming future situations, you can either rely on past performance, industry publications or correspondence from customers and suppliers. Your predictions should include:

• timing and quantum of price increases — both yours and your suppliers’;

• sales growth estimates;

• impact of seasonality;

• provision for general cost increases;

• provision for internal salary and wage increases.

2. Prepare a list of sales income

Sales can be difficult to predict, and often the best place to start is to look at sales in previous years to identify trends. You can then identify internal and external factors that are likely to impact the current period and make necessary adjustments.

3. Prepare a list of ‘other’ estimated cash inflows

To ensure your cash flow forecast is complete, compile a list of all other anticipated cash inflows such as the insurance proceeds, government grants receipts, cash from asset divestment etc.

4. Prepare a list of estimated expenses

These should include direct and indirect expenses. Cash outflows relating to financing and investing activities should be included (payments to suppliers, wages, and salaries of all staff, purchase of new assets, loan repayments etc.).

5. Putting the information together

Simply put, a cash flow forecast is a rolling calculation based an opening cash position, adding cash inflows and deducting cash outflows, to arrive at a closing cash position.

However, you have to be aware of some things. Cash flow forecasts record money flowing in and out of your business or project over a number of periods of time — they will not show your reported income. This is affected by wider factors such as depreciation and amortisation. These things you cannot control.

We have to remind you, though, that a healthy cash flow is all about good management. As a business owner or manager, you have to pay extra attention to the flow of sales in your business, sales on credit, receivables, inventory and payables.

Try ThinkOut and see how it can help you with that. Let us know what you think. We’d love to hear from you.

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Read our blog

Learn more about cash flow management

Cash flow, Entrepreneurship

How to use cash flow forecasts to get a loan

A forecasted overview of your company can bring many benefits for the business itself and for you, as a manager.

August 30, 2021

Read more

Cash flow

Budgeting vs Cash Flow Forecasts

Use budgets and cash flow forecasts in order to establish your business' direction.

March 18, 2021

Read more

Cash flow

The hidden perils of cash flow forecasting

Small and fast-growing companies need a cash flow forecast to keep the business safe. But what about those perils?

February 15, 2017

Read more