Entrepreneurship

Let’s talk Fintech

March 05, 2018

It’s been almost a decade since fintech has entered the business conversation around the world, becoming lately a rising star on both the tech and financial scenes. Though a little slower than other entities, the financial institutions finally understood that the road ahead is paved with apps, automation, AI and everything else that makes the customer’s life easier and helps businesses to get more efficient.

No wonder that large banks like Wells Fargo in the U.S. and Barclays or ING in Europe have started investing into startup accelerators, looking for tech driven solutions to help take their operations to the 21 century. Such giants finance startups to bring their fintech solutions on the market and at a level that is best serving customers, in order to integrate that technology to their own offer of services. So we’ll be seeing quite a bit of new players partnering or getting acquired by veteran financial institutions, shaping the new financial services of the Online Era.

The big question is how exactly will these services look like? What will change in our way of dealing with money?

If we take a quick look at what kind of startups are financed within these accelerators, we can get a pretty good picture. Digital solutions, payments, trading, insurance, crypto currency – these are the emerging trends that point to the future of the financial world. What will happen exactly, no one knows for sure. It is an ongoing process that transforms and adapts as it goes. With the PSD2 directive being applied in Europe starting 2018, changes will be in place faster than we think. European banks are already “hunting” for fintech startups to help them transition to the new requirements of democratizing financial services.

When we started to build ThinkOut, we knew it had to be something more than cash flow management. We knew that it should automate as much as possible and become something more of a business assistant for managers in the creative businesses. As we went on, we got more aware of the industry advancements, so Bank Settlement came as a natural development. With the development of AI and chatbots, we know this is the path to follow and we’ll take the necessary steps to keep up.

We witness an ever-evolving fintech world with new opportunities popping out; there is still a lot of room for innovation and disruption and we cannot tell for sure how things will look like. What we can tell is that payments will be made faster, easier, from unique platforms, the crypto currency will gain terrain, investing and trading services will become accessible to a larger number of customers and all that with the help of the online and the new financial technologies.

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Read our blog

More about Fintech and startup life

News

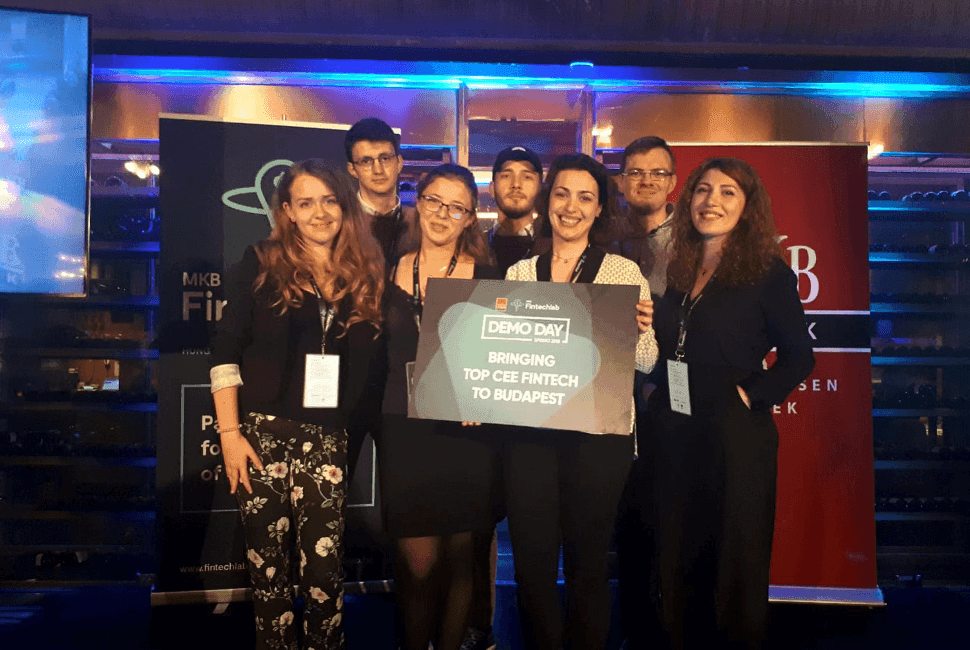

What happens in the accelerator, doesn’t stay in the accelerator

We had a first-hand experience with what happens in a startup accelerator in Budapest, Hungary.

June 06, 2018

Read more

Entrepreneurship

All you need to know about Open Banking and PSD2

Open Banking is the new way in which banks allow third-parties (other financial service providers) access to consumer data.

March 29, 2021

Read more

Entrepreneurship, News

The startup beat as felt by a Startup Weekend facilitator

An interview with Galin Zhelyazkov, international facilitator for the Startup Weekend events.

November 18, 2016

Read more