Entrepreneurship

How to prepare your 2021 budget

November 26, 2020

What is a budget and how to prepare it for your company?

A budget is a financial plan, a list of cash inflow and outflow estimations for a defined period of time. It will offer you a proper overview of your business financials and the way the team spends it in order to achieve the organizational goals.

Feel free to design your budget for each department, for a year or a semester, for each project or for the entire company. Build it based on your actual business needs.

Use a budget whenever you need to check different scenarios and how specific decisions might influence your entire business. It will also help you to know how much money you need in order to cover all the monthly expenses, if you afford another equipment or if you’re ready to take on another project. Most of the businesses work on a yearly budget at the end of each year and we encourage you to do the same if possible.

Take ThinkOut for a spin

Build your 2021 budget and easily track what percentage actually happened every day

Start free trialWhen you’re ready to start working on your budget, keep in mind that you will need some data about your financial activity, such as:

✓ Current balance or how much money you have now ✓ Sales volume (maybe you already have some projections prepared) ✓ Monthly costs (fixed and variable) ✓ The frequency of your transactions or how often you pay or receive money ✓ One offs or the payments that are happening just once in a while (purchase of a car) ✓ Some data about past payment delays

Planning your inflows

Start by putting together all the cash inflows you expect for the next period. Think about your sales projections and organize it on a timeline. Apart from your operational revenue, make sure you add other types of inflows, if necessary, such as a credit line or a governmental help. Take into consideration potential prolonged due dates or cancellation of a contract so do not make big investments based on unsure revenue.

Planning your outflows

Next step is about adding your monthly fixed costs that you have no matter the sales level. Some examples may include the rent, salaries, installments and subscriptions. In order to help you more, try to organize everything based on a category structure.

If your fixed costs are higher than your inflows then there’s a problem, of course. What you can do about it is to try to reduce or defer some of the payments. Another option is to convert the fixed costs into variable (e.g. salary and commission).

Double check and make sure you included all inflows and outflows for the period you are planning on. Calculate your monthly net result and see if you can cover everything or you need external help.

Regular adjustments

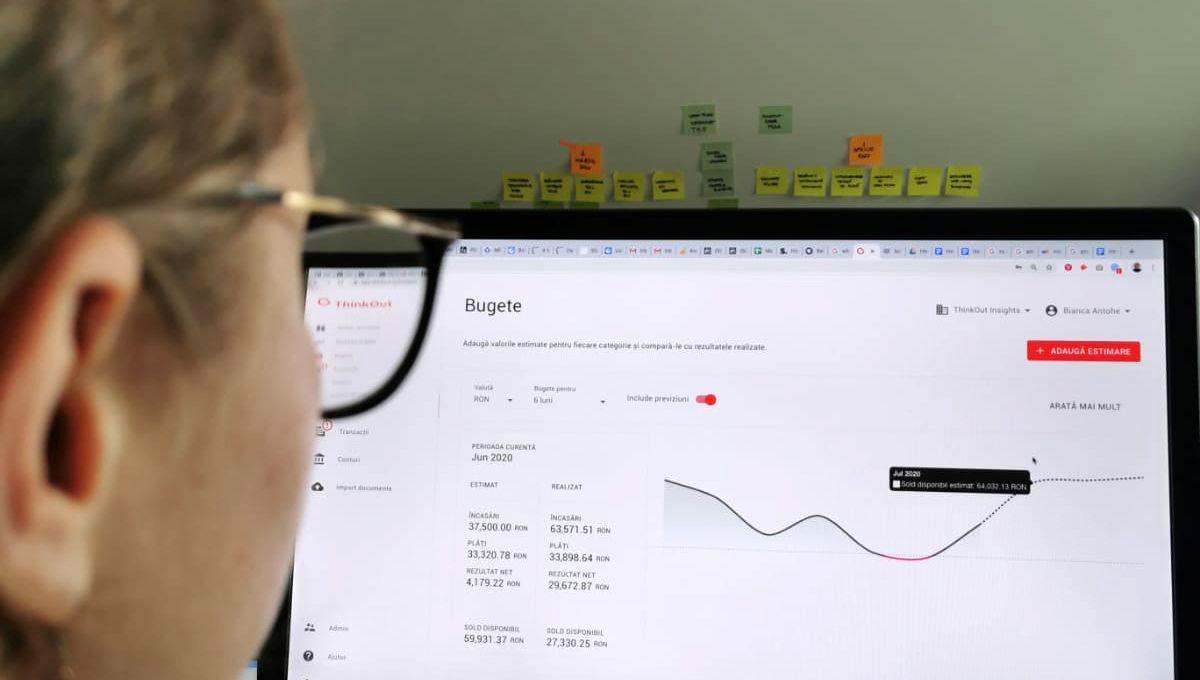

The habit of constantly reviewing your budget is as important as the process of building one. Review your budget at least once every month and see what percentage happened already, meaning the amount of money you already collected or paid. An updated cash flow plan will come in handy here. Easily configure it in ThinkOut based on a secured bank connection.

Adjust your budget based on the fresh cash flow data in order to have an updated image of your business. Make sure you tweak your next estimations and verify your future financial status.

When using a budget you actually compare all your business inflows and expenses so you know how much money you can count on. There’s no need to add data at the transaction level here, an estimation per each category will do the job. If you don’t know where to start from, checking the past monthly expenses might help.

Compared to the cash flow plan that monitors the exact moment when money comes in and goes out of your account, a budget is an approximate financial image about your company’s resources and the way they are used for future growth. Basically a budget will tell you how, while the cash flow, when. Use it together and take informed business decisions.

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Keep reading

Find out more about budgeting

Cash flow, Product features

TO #1 How to set up and maintain a budget for my business?

Setting up your budget shouldn’t be a headache, even though you prefer to do anything else but financial analyses and planning.

April 28, 2021

Read more

Cash flow

Budgeting vs Cash Flow Forecasts

Use budgets and cash flow forecasts in order to establish your business' direction.

March 18, 2021

Read more

Entrepreneurship

Year-end checklist for your company

In the midst of this hustle and bustle, it is important for you to carry on with your activities that can help you grow your business.

December 09, 2021

Read more