Entrepreneurship

How much risk is too risky?

November 29, 2017

You decided to quit your 9 to 5 job and pursue your dream into running a business. A lot of excitement, calculations, plans, research, more excitement. You finally start and a curvy road opens ahead, waving through gorgeous landscapes, sometimes on the edge of high cliffs, up and down, full of surprises and rewards.

This is pretty much how the entrepreneurship journey looks like; anyone who embarks is (or should be) prepared to take the chance and face the unexpected, which may occur just after the next curve to the right. In other words, entrepreneurs take risks; it’s part of their DNA and lifestyle. Risk, in certain amounts, is good; it helps to seize opportunities, grow, learn. However, too much risk is risky; it can drive to reckless decisions and undesirable outcome. But how do you know where to draw the line?

When we talk about risk, we often think of the financial involvement. There are also other types of risks that entrepreneurs face, from hiring the wrong persons to product-market mismatches. We’ll focus our ideas on the financial risks, though, as we are in the cash flow management business.

There are various situations when an entrepreneur takes a financial risk: growth, new market entrance, pivoting, new product development, acquisition. These moves imply investment; for a growing company, this money usually comes as a funding round or from a lender. Either way, there is pretty much at stake and the entrepreneur can lose a great deal if things don’t go as planned – thus the risk taking.

Now, while some people prefer to play safe and take the lowest risk, others prefer to seize the opportunities no matter what. The truth is there is no one good way; it all depends on the entrepreneur’s perspective on risk taking. As Ami Kassar, CEO of MultiFunding.com explained in a series of articles in Inc., lenders divide entrepreneurs into three categories from the point of view of inclination towards risk: risk-averse, risk-neutral or risk-flexible.

For the risk-averse entrepreneurs, it is safer to use self-funding or conventional lenders, where risk is low and finances are well planned ahead. For them, the nature of collateral and amount of interest are the line between worth-taking-the-risk and too-risky-to-try.

The risk-neutral entrepreneurs are more inclined to ignore risky implications and seize an opportunity, being certain of their chances to make it. This means they can add collateral to obtain better financing if they feel that investing into growth will undoubtedly translate into more revenue, enough to cover the financial costs.

As for the risk-flexible entrepreneurs, they are even more open to situations that are prone to reward their efforts, no matter the risk. For them, an equity partner is a very good alternative to borrowing money and they don’t see it as too risky to partially cede control. They can even accept to guarantee with the personal property just to obtain the money they need to go ahead with their plans, provided the positive outcome is clear.

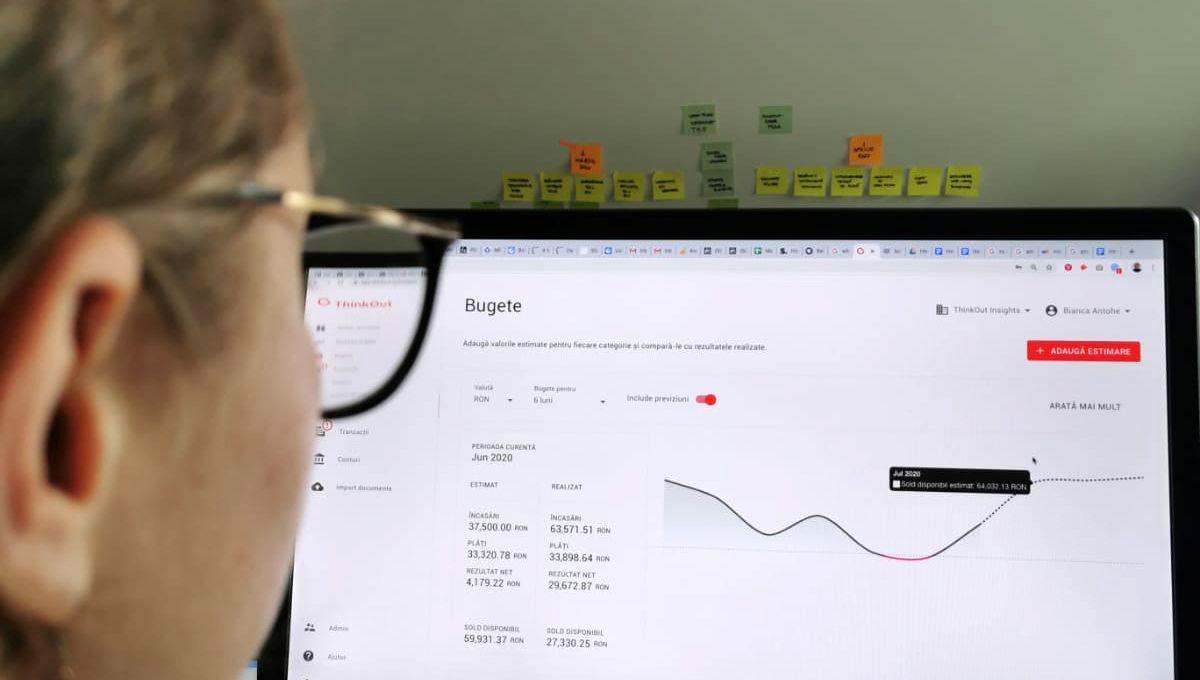

One good way to assess where things become too risky is to forecast. With cash flow as one of the major reasons for business failure, a_ cash flow forecast_ is what you need. No matter the source of investment, it all comes down to the ability to pay the costs; this depends on the revenue streams and the timing. You may very well anticipate enough income in a year’s time, but meanwhile, you still need to pay salaries, office costs, not to mention interest. So write down those forecasted numbers and see if revenue covers expenses on regular basis. When the balance starts to get negative, it is time to consider whether you are willing to take that risk and continue with your investment plan.

Start forecasting with ThinkOut

Sign up for a free accountSometimes taking risks drives to extraordinary results; sometimes not. In the end, it is a matter of your appetite for risk and what the cash flow forecast tells you.

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Read our blog

Learn more about cash flow management

Cash flow

Budgeting vs Cash Flow Forecasts

Use budgets and cash flow forecasts in order to establish your business' direction.

March 18, 2021

Read more

Cash flow

3 things to do in order to avoid a cash flow crisis

A cash flow plan properly organized and updated is valuable decision support for entrepreneurs.

October 29, 2020

Read more

Entrepreneurship

How much debt is too much for your company?

To find the answer to this question, leverage ratios will come in handy, as they offer valuable information about your company.

November 02, 2020

Read more