Cash flow

5 Tips on Cash Flow Management in E-commerce

October 17, 2022

The e-commerce sector is booming and becoming more and more complex. If you have a business in this field, do your best to build a strategy that helps you carefully manage your cash flow plan.

Remember, cash flow keeps your business alive. While this is true for any business, cash flow management for an e-commerce business can look very different from that of a brick-and-mortar store.

You must balance elements such as multiple sales channels, different payment processors, and perhaps cashing in more than one currency. That is why we put together a list of helpful tips to help you better organize the financial management side of your online shop.

Tip #1: Organize your cash flow plan carefully

Good data organization is an essential part of the financial management process.

We suggest you categorize information such as the type of products sold, customers, sales channels, and different taxes or commissions. This way, you can make sure that you have accurate information at hand when you have to deal with financial reporting.

From the information you can extract from your trading activity, you should be able to get a clear picture with essential details such as:

• What are the products with the highest demand?

• What are the most profitable sales channels?

• Customer lifetime value (the total amount that a customer spends on your products during the business relationship)

While this is valuable information, it can take quite a bit to obtain it. Some entrepreneurs prefer to personally deal with an Excel table that is difficult to follow or delegate this responsibility to someone else, then again, another option is to use a tool that automates these processes to gain more time to focus on more important things.

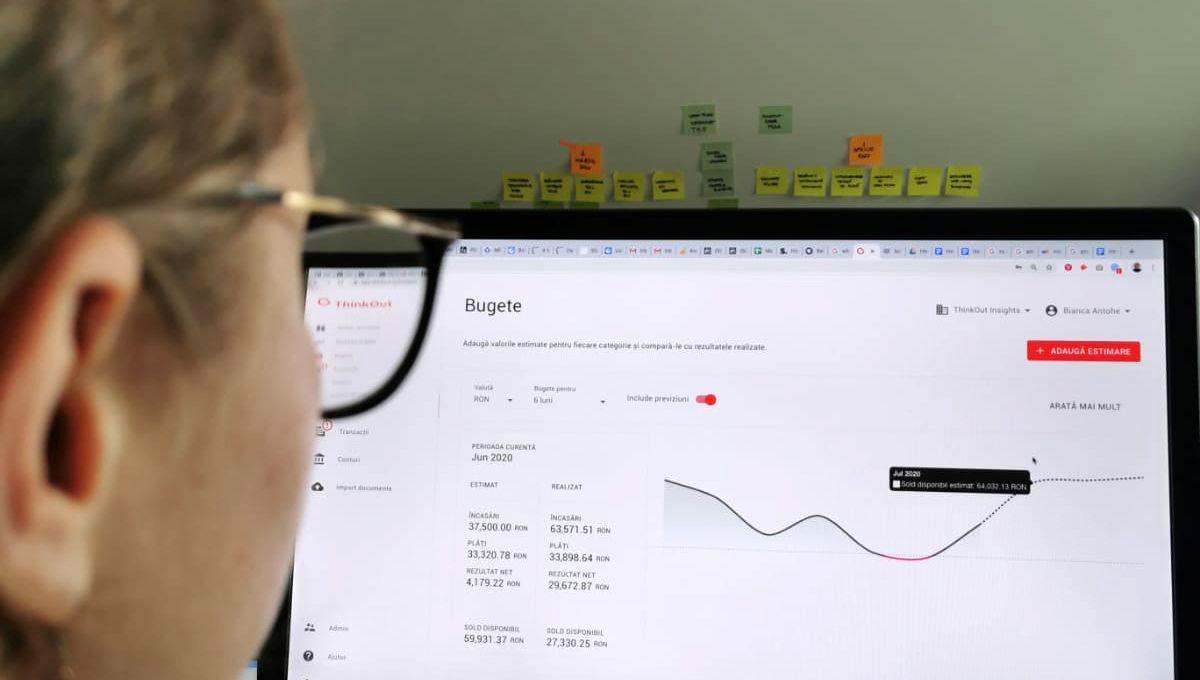

You can use a solution like ThinkOut, which helps you quickly synchronize transactions from different sales sources and provides you with reports on your business activity.

Tip #2: Do your best and focus on financial planning

You can make predictions based on your goals. It is important to plan so you can have a clear image of the next inflows, keep your expenses under control or find out if you need to use a line of credit to keep the business going in the next months.

For example, you could use forecasts to plan a sales campaign. For this, it is necessary to take into account the inventory to find out how many products you currently have stocked and how much more would be needed so that you know if you can pay with the money you now have in your accounts. Also, take into consideration the amount you need to invest in marketing campaigns (online and/or offline promotion) to obtain the results you want.

As a rule of thumb, in order not to be caught off guard, make sure that you do financial planning in different directions, such as:

- Future stock purchases

- Purchasing new equipment

- Marketing campaigns

- Launching new products

- Hiring new people

- Paying all kinds of taxes

Tip #3: Organize your expenses according to the period when you earn the most

Pay close attention to which month more inflows come: at the beginning, middle, or end. Did you notice a pattern? Try to synchronize your topmost expenses with the period when you sell more; this way, you won’t get close to the “red zone”.

Another tip: some providers offer payment terms of 60 or 90 days which means you can take advantage of this situation. If you have a good relationship with some suppliers, negotiate with them for extra time to pay your bills.

Tip #4: Use a solution that offers you information about transactions in different currencies

If you wish to sell products in other countries, you should decide how to handle multi-currency transactions. Accepting payments in more currencies will mean more collections, but financial monitoring will also become more complex.

For example, you’ll need to keep track of your taxes regularly (monthly, quarterly), but also of your income streams.

Track and analyze all transactions with different currencies in your bank accounts with ThinkOut

Sign up for a 30-day free trial accountTip #5: Check your financial reports regularly

Constant financial reporting is something that every entrepreneur must keep in mind. Don’t just rely on what you get from your accountant, do your best to keep a record of all inflows and payments yourself.

Make sure you look for a solution that can help you make decisions while you still can and provides essential information about revenue, profitability, products, customers, expenses, suppliers, fees, and taxes.

Because the e-commerce industry is dynamic and ever-changing, you need to keep an eye on the financial health of your business at all times.

Don’t forget that effective management and good cash flow forecasting will help you in the long run and make a difference when you plan to grow your business.

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Read our blog

Learn more about cash flow management

Product features

6 reasons why ThinkOut is better than Spreadsheets

Find out why you should use our dedicated tool for cash flow management instead of spreadsheets.

October 31, 2016

Read more

Cash flow

5 reasons why you need a cash flow solution for your business

Have you ever wondered why it is so important to have a cash flow plan at hand?

February 28, 2023

Read more

Cash flow

Budgeting vs Cash Flow Forecasts

Use budgets and cash flow forecasts in order to establish your business' direction.

March 18, 2021

Read more