How to forecast your business cash flow for 2021

If you haven’t done it already, this beginning of the year is the perfect moment for you to start planning your business inflow and outflows. With all the instability that’s characteristic for this last period, a clear overview of your future business finances might be exactly what you need to start fresh in 2021.

With ThinkOut it’s easy to check your current and future financial position. Sign up for free and see it for yourself.

Why?

With cash flow forecasts you gain more confidence in running your business. You know if you’ll have enough money to pay all the bills at the end of the month, you avoid cash flow crises and maintain a healthy relationship with your business partners.

A cash flow plan helps you to understand the impact of your decisions on the company. Want to hire someone new or buy more performant equipment? Check first if you can afford it.

A proper cash flow plan gives you the necessary support in tracking invoices. You probably already know how inefficient it is to collect your money late and block precious cash in overdue invoices.

Cash flow forecasts transpose to budgeting confidence. Set up your sales target for the next period and use cash flow forecasts in order to better understand if and when you’ll achieve your goals.

Cash flow predictions give you time to prepare in advance for rainy days (periods with lower inflows). If your company is highly influenced by seasonality, it’s really important to carefully plan your available cash in order to keep your business afloat until the next sales increase.

With a periodically updated cash flow you know ahead of time if there will be any cash surplus in your bank account. This is a good time to start thinking about your next investment.

If you want to do cash flow planning and updating periodically there’s no need to waste a lot of time and energy with Excel. Start doing it in ThinkOut.

- Signup for a 30 days free trial.

- Connect your bank account in order to automatically refresh your daily transactions.

- Add cash forecasts and start building your future financial picture.

- Every time a prediction is due, ThinkOut will notify you.

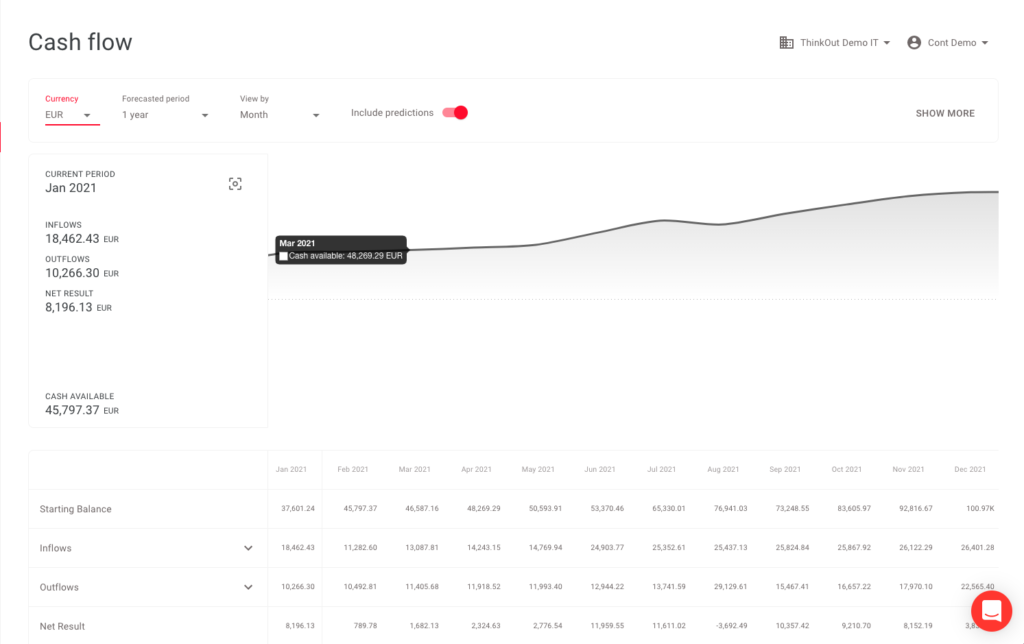

Here’s how your cash flow forecasts can look like if you follow these 3 simple steps.

Do you need a clear financial overview of your business? Try ThinkOut for free and we’ll help you to always be up to date with what’s happening in your business from a cash flow perspective.

Interested in financial planning for businesses? Continue to read our last articles on how to build financial forecasts or how to prepare your budget for 2021.