Here Is How You Can Find Out How Productive Your Business Is

As an entrepreneur, you’re committed to making your business grow and this means you have to keep an eye on a lot of information that keeps you on top of everything you need to know.

Making business decisions isn’t always easy, it takes more than a gut feeling; actually, it takes the right interpretation of data and what you’re doing with it.

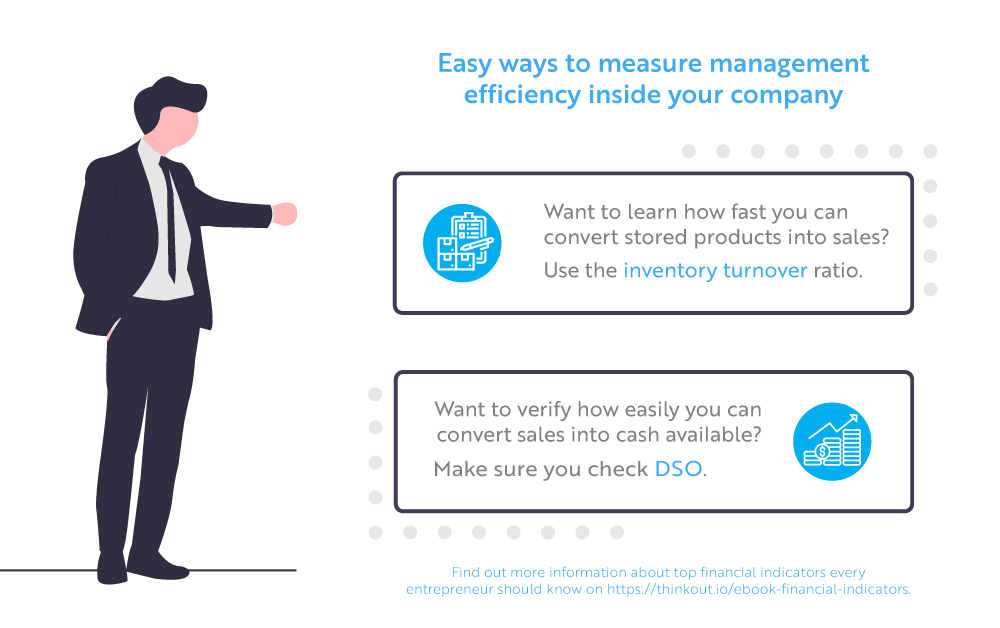

Business owners are required to monitor business performance and increase overall efficiency. And speaking of that, there is one category of financial KPIs, the efficiency ratios, which help you understand how productive you are in using the company’s assets.

Inventory turnover

One important efficiency ratio is the inventory turnover that measures how many times a company sells its inventory during a given period.

How do you calculate it?

Inventory turnover = COGS/Average inventory

You can use this information to identify the proper moment to make a new inventory order. This way you reduce cash tied up in inventory and the storing costs and you positively influence profit by assuring a balance between turnover and COGS. Also, you reduce the risk of being left with an inventory that is affected by seasonality.

The higher the inventory turnover, the tighter your management of inventory, and the better your cash position. So long as you have enough inventory to meet your current clients’ needs and the more efficient you can be, the better.

How about Days Sales Outstanding?

Days sales outstanding, also known as average collection period, is measuring how long it takes your clients to pay your invoices.

You can calculate DSO by using this formula:

DSO = (Accounts receivable / Turnover) * 360

This indicator highly influences cash flow so you’ll need to carefully monitor it.

Our advice is to try and keep a balanced DSO, not too low — it can badly influence your commercial relations — and not too high either. As in most cases businesses face the second situation, here’s what you can do in order to obtain the desired DSO:

- Check your future clients prior to signing any contract;

- Send all invoices on time;

- Offer various payment methods;

- Offer your clients an easy way to reach you in case they have any questions;

- Send reminders;

- Implement early payment discounts.

If you’re interested in finding out what are the most used efficiency ratios, how to calculate and use them to carefully monitor your business activity, download our latest ebook — Top financial indicators every entrepreneur should know.